Your Resources to Filing Taxes

Do I need to file a tax?

As an international student, you need to file your taxes every year, no matter if you have worked or just studied whole year. Even if you are an international student who didn't attend UofA in-person or are still out of Canada, still you should file your tax. If you do not have a SIN or an address in Canada, or any other documentation is missing, then you could file it next year but meet with ISS staff and try your best to file tax this year if you could.

What happens if you don't file a tax?

If you don't file it this year, then at later some point you will have to file it anyway, if you have only studied for a whole year then this might work for a few, but if you have worked in Canada, in-person or online then you must file a tax return.

What happens after-tax return?

If you qualify then you would get some amount from your taxes back, thus you will get some amount of money back.

Deadline for filing Tax?

April 30, 2021

There are few exceptions to this deadline.

How to file tax?

File it yourself!

Yes, it's that easy, just watch these four videos by ISS and file your tax yourself for FREE.

Need Help?

Go to the Tax Filing Workshop hosted by ISS.

March 23, April 6, April 20, and April 27, 2021

Time: 5 pm - 6 pm (MDT)

Online via Zoom

Get a step-by-step walk-through on how to file your tax return online. Bring your tax slips and get ready to follow along.

These workshops are held by UAlberta ISS and thus are FREE for UAlberta International Students.

Need Individual Support:

March 22 - April 30, 2021

Monday, Wednesday, Thursday and Friday: 2 - 4 pm

Tuesday: 9 - 11 am

Online via Zoom

Book an online one-on-one support session for specific issues and troubleshooting your tax documents. Before you make an appointment with an advisor, watch the video tutorials first. Each video takes you through the steps on how to file your Canadian income taxes successfully.

These sessions are held by UAlberta ISS and thus are FREE for UAlberta International Students.

For most updated information about ISS workshops and sessions, check out their website,

I can't simply file my tax on my own!

University of Alberta Accounting Club (UAAC) Annually hosts a Tax Clinic and they can help you to file your Tax using Zoom Breakout Rooms. This option is also FREE.

From March 8th-26th, 2021.

I have a more complicated Tax situation and need Tax professional support!

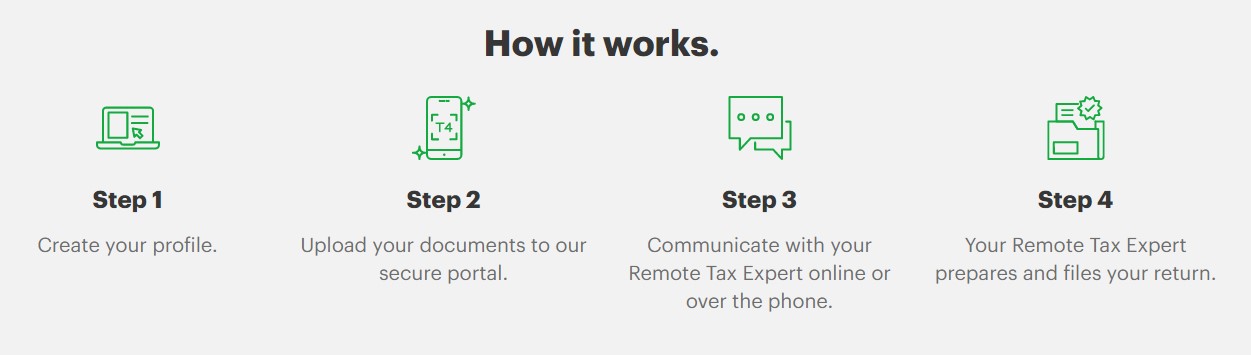

In this case, you would have to take help from a tax filing company. Such as H&R Block.

It's a private company, thus you would have to pay for their service and they do have remote tax filing options.

Picture Credit: H&R Block

Disclaimer!

The ISA is not responsible for the information accuracy on this website. The ISS, UAAC and H&R might change their services and thus the students are requested to check their websites for the most updated information. ISA does not have any affiliation or partnership with ISS, UAAC and H&R, thus we do not guarantee or are responsible for their services. The ISA is just sharing the information and is not responsible for the accuracy of their information as the information might change with time. This webpage will not be regularly updated.